SHIB Price Prediction: Assessing Investment Viability Amid Technical Weakness and Negative News

#SHIB

- Bearish Technical Posture: SHIB trades below its 20-day moving average with a negative MACD, indicating dominant selling pressure and a lack of positive short-term momentum.

- Negative Sentiment Catalyst: News of an unreported multi-million dollar bridge hack scrutinizes the team's transparency, likely damaging investor confidence and amplifying selling pressure.

- High-Risk Profile: The combination of technical weakness and fundamental concerns suggests SHIB is not a favorable investment in the immediate term, requiring caution and waiting for stabilization signals.

SHIB Price Prediction

Technical Analysis: SHIB/USDT Shows Bearish Pressure Below Key Moving Average

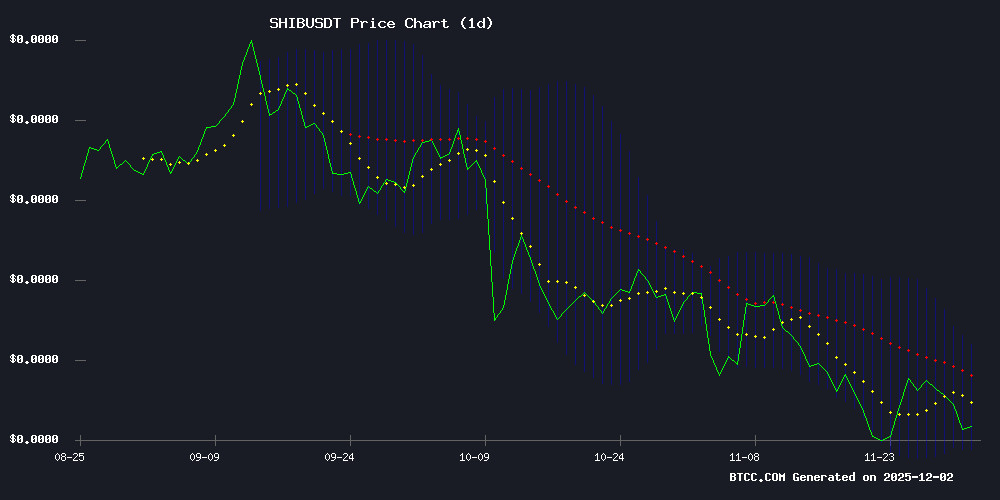

According to BTCC financial analyst Sophia, SHIB is currently trading at 0.00000792 USDT, which is below its 20-day moving average of 0.00000850. This positioning suggests the asset is facing immediate bearish pressure. The MACD indicator, with a value of -0.00000007, confirms a short-term bearish momentum as the signal line remains above the MACD line. Price action is currently near the lower Bollinger Band at 0.00000763, indicating the asset is in an oversold territory. A sustained break below this level could trigger further selling, while a rebound towards the middle band at 0.00000850 WOULD be the first sign of stabilization.

Market Sentiment: Negative Headline Weighs on SHIB's Narrative

BTCC financial analyst Sophia notes that the recent news of the shiba inu team facing scrutiny over an unreported $3 million bridge hack introduces a significant negative sentiment factor. Such events typically erode investor confidence, raising concerns about project transparency and security. This headline is likely to amplify the existing technical weakness, potentially leading to increased selling pressure or delayed recovery as the market digests the implications. The news reinforces a cautious short-term outlook, aligning with the bearish signals from the technical analysis.

Factors Influencing SHIB’s Price

Shiba Inu Team Faces Scrutiny Over Unreported $3M Bridge Hack

Shane Cook, founder of Pulse Digital Marketing, has publicly challenged the Shiba Inu development team's silence following a $3 million exploit of the Shibarium Bridge in August 2023. The breach drained user funds but was never formally reported to law enforcement.

The incident raises questions about accountability in decentralized projects, particularly meme coins like SHIB that have evolved into ecosystems with real financial stakes. Cook's allegations suggest either negligence or intentional obfuscation by the anonymous team.

This follows a pattern of unreported crypto exploits—Chainalysis estimates only 23% of DeFi hacks are investigated. The lack of disclosure may expose SHIB holders to further risks as regulatory scrutiny intensifies.

Is SHIB a good investment?

Based on the current technical and fundamental backdrop, SHIB presents a high-risk profile for investors at this moment. The confluence of bearish technical indicators and negative news creates a challenging environment for near-term appreciation.

Key Data Snapshot (2025-12-02):

| Metric | Value | Implication |

|---|---|---|

| Current Price | 0.00000792 USDT | Below key MA, showing weakness |

| 20-Day MA | 0.00000850 USDT | Acts as immediate resistance |

| MACD Histogram | -0.00000007 | Confirms bearish momentum |

| Bollinger Band Position | Near Lower Band (0.00000763) | Oversold, but break lower is risk |

| Key News | $3M Unreported Hack Scrutiny | Negative for sentiment and trust |

As BTCC financial analyst Sophia highlights, the investment case is currently weak. The price is below a key moving average, momentum is negative, and the project faces credibility issues. For a speculative asset like SHIB, community trust and momentum are crucial drivers, both of which are under pressure. Potential investors should wait for signs of both technical stabilization (e.g., a reclaim of the 20-day MA) and a resolution or clear communication regarding the security incident before considering an entry. The current setup suggests further downside risk is more probable than an immediate rally.